Directors and senior officers in a business are paid to make big decisions, but if those decisions are wrong, things can get very costly.

Directors and officers (D&O) liability insurance covers the costs of settling claims for damages that result from poor decisions. Usually, D&O policies cover costs relating to wrongful decisions, but not those decisions that are classed as criminal acts or that are designed to personally benefit the director.

Examples of events covered by directors and officers (D&O) liability insurance can include mistakes or missing information in company accounts or other financial documents, or failing to properly enforce human resources policies.

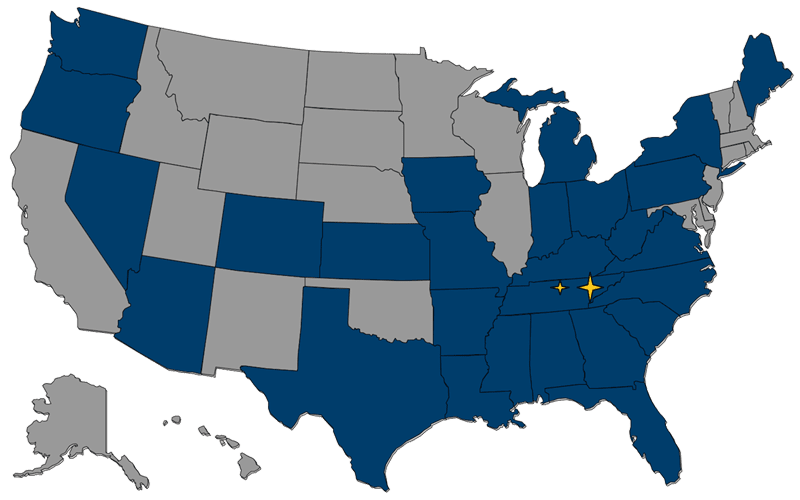

Depending on the state the business is based in–specifically, its rules on director indemnification–the policy could cover damages and costs paid by the individual or by the business.

It’s always important to check the details of a D&O liability insurance policy carefully, as the coverage period may detail when the claim against the person is made, not when the failing or mistake happened.

If you’re looking to protect your business from potentially wrongful decisions made by directors and officers, then a D&O liability insurance policy could be a great fit. We can help you get started!